Can You Take Bonus Depreciation On A Building . Can i take bonus depreciation on real estate property? Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. Suppose you’re purchasing new real estate property for your rental business in tax years when bonus. Qualified improvement property is considered any improvement made to an interior portion of a nonresidential building that was. If you purchase property that qualifies for bonus depreciation, and for whatever reason don’t want to write off 100% of the cost, you can elect not. You can elect to take an 80% special depreciation allowance for property acquired after september 27, 2017, and placed in service after december 31, 2022, and before january 1, 2024.

from businessfirstfamily.com

You can elect to take an 80% special depreciation allowance for property acquired after september 27, 2017, and placed in service after december 31, 2022, and before january 1, 2024. If you purchase property that qualifies for bonus depreciation, and for whatever reason don’t want to write off 100% of the cost, you can elect not. Qualified improvement property is considered any improvement made to an interior portion of a nonresidential building that was. Suppose you’re purchasing new real estate property for your rental business in tax years when bonus. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. Can i take bonus depreciation on real estate property?

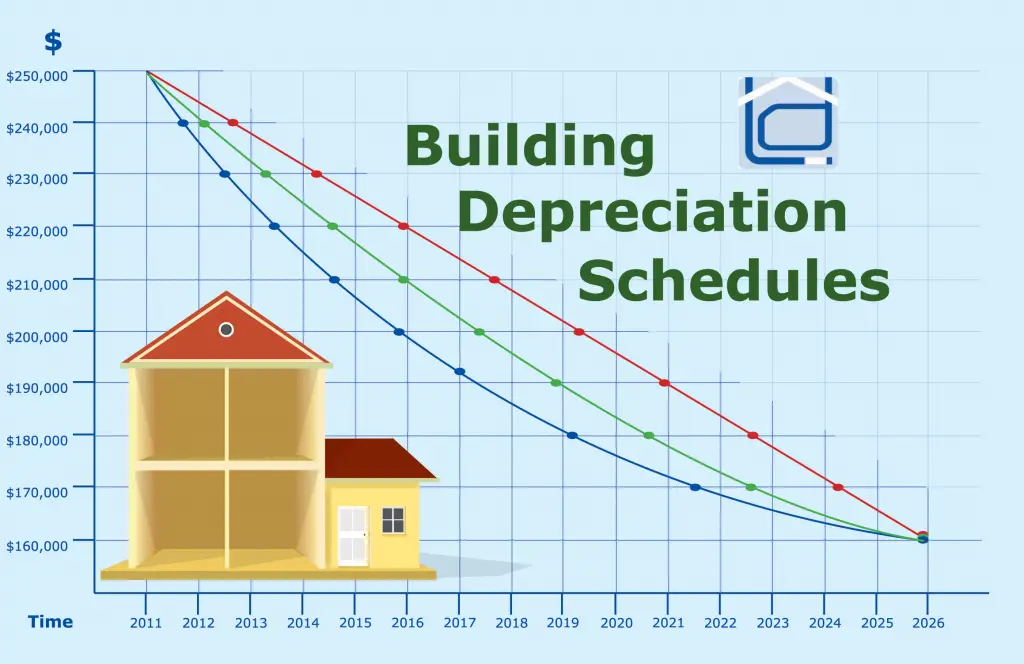

Popular Depreciation Methods To Calculate Asset Value Over The Years

Can You Take Bonus Depreciation On A Building If you purchase property that qualifies for bonus depreciation, and for whatever reason don’t want to write off 100% of the cost, you can elect not. You can elect to take an 80% special depreciation allowance for property acquired after september 27, 2017, and placed in service after december 31, 2022, and before january 1, 2024. Can i take bonus depreciation on real estate property? Suppose you’re purchasing new real estate property for your rental business in tax years when bonus. Qualified improvement property is considered any improvement made to an interior portion of a nonresidential building that was. If you purchase property that qualifies for bonus depreciation, and for whatever reason don’t want to write off 100% of the cost, you can elect not. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production.

From www.deskera.com

What is Accumulated Depreciation? How it Works and Why You Need it Can You Take Bonus Depreciation On A Building Can i take bonus depreciation on real estate property? Qualified improvement property is considered any improvement made to an interior portion of a nonresidential building that was. Suppose you’re purchasing new real estate property for your rental business in tax years when bonus. You can elect to take an 80% special depreciation allowance for property acquired after september 27, 2017,. Can You Take Bonus Depreciation On A Building.

From www.chegg.com

c. Compute the maximum 2023 depreciation deductions, Can You Take Bonus Depreciation On A Building You can elect to take an 80% special depreciation allowance for property acquired after september 27, 2017, and placed in service after december 31, 2022, and before january 1, 2024. Suppose you’re purchasing new real estate property for your rental business in tax years when bonus. Qualified improvement property is considered any improvement made to an interior portion of a. Can You Take Bonus Depreciation On A Building.

From financialfalconet.com

Adjusting Entry for Depreciation Financial Can You Take Bonus Depreciation On A Building Qualified improvement property is considered any improvement made to an interior portion of a nonresidential building that was. If you purchase property that qualifies for bonus depreciation, and for whatever reason don’t want to write off 100% of the cost, you can elect not. You can elect to take an 80% special depreciation allowance for property acquired after september 27,. Can You Take Bonus Depreciation On A Building.

From realsource.com

What is Bonus Depreciation and How Can I Take Advantage in Today's Can You Take Bonus Depreciation On A Building Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. Qualified improvement property is considered any improvement made to an interior portion of a nonresidential building that was. Suppose you’re purchasing new real estate property for your rental business in tax years when bonus. If. Can You Take Bonus Depreciation On A Building.

From www.blockadvisors.com

Bonus Depreciation for Deducting Business Costs Block Advisors Can You Take Bonus Depreciation On A Building If you purchase property that qualifies for bonus depreciation, and for whatever reason don’t want to write off 100% of the cost, you can elect not. Can i take bonus depreciation on real estate property? Qualified improvement property is considered any improvement made to an interior portion of a nonresidential building that was. Suppose you’re purchasing new real estate property. Can You Take Bonus Depreciation On A Building.

From www.buildium.com

Bonus Depreciation Saves Property Managers Money Buildium Can You Take Bonus Depreciation On A Building Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. Suppose you’re purchasing new real estate property for your rental business in tax years when bonus. Can i take bonus depreciation on real estate property? You can elect to take an 80% special depreciation allowance. Can You Take Bonus Depreciation On A Building.

From www.blazartax.com

Can you take 100 bonus depreciation? Can You Take Bonus Depreciation On A Building Can i take bonus depreciation on real estate property? Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. Qualified improvement property is considered any improvement made to an interior portion of a nonresidential building that was. You can elect to take an 80% special. Can You Take Bonus Depreciation On A Building.

From financialfalconet.com

How to calculate bonus depreciation Financial Can You Take Bonus Depreciation On A Building You can elect to take an 80% special depreciation allowance for property acquired after september 27, 2017, and placed in service after december 31, 2022, and before january 1, 2024. If you purchase property that qualifies for bonus depreciation, and for whatever reason don’t want to write off 100% of the cost, you can elect not. Under the new proposed. Can You Take Bonus Depreciation On A Building.

From georgiaropreilly.blogspot.com

Depreciation of Manufacturing Equipment Can You Take Bonus Depreciation On A Building If you purchase property that qualifies for bonus depreciation, and for whatever reason don’t want to write off 100% of the cost, you can elect not. Suppose you’re purchasing new real estate property for your rental business in tax years when bonus. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its. Can You Take Bonus Depreciation On A Building.

From taxmethodexperts.com

Bonus Depreciation and TCJA Changes to Section 168 TPTM Can You Take Bonus Depreciation On A Building Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. Qualified improvement property is considered any improvement made to an interior portion of a nonresidential building that was. You can elect to take an 80% special depreciation allowance for property acquired after september 27, 2017,. Can You Take Bonus Depreciation On A Building.

From www.linkedin.com

Bonus Depreciation in Real Estate Investment is being Phased Out Can You Take Bonus Depreciation On A Building Qualified improvement property is considered any improvement made to an interior portion of a nonresidential building that was. Can i take bonus depreciation on real estate property? Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. Suppose you’re purchasing new real estate property for. Can You Take Bonus Depreciation On A Building.

From investguiding.com

Bonus Depreciation Rules For Rental Property Depreciation (2023) Can You Take Bonus Depreciation On A Building Suppose you’re purchasing new real estate property for your rental business in tax years when bonus. Qualified improvement property is considered any improvement made to an interior portion of a nonresidential building that was. You can elect to take an 80% special depreciation allowance for property acquired after september 27, 2017, and placed in service after december 31, 2022, and. Can You Take Bonus Depreciation On A Building.

From www.pinterest.com

Pin on business stuff Can You Take Bonus Depreciation On A Building Can i take bonus depreciation on real estate property? Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. Suppose you’re purchasing new real estate property for your rental business in tax years when bonus. Qualified improvement property is considered any improvement made to an. Can You Take Bonus Depreciation On A Building.

From www.ssacpa.com

Don’t miss out on bonus depreciation before it's too late Sol Schwartz Can You Take Bonus Depreciation On A Building Can i take bonus depreciation on real estate property? If you purchase property that qualifies for bonus depreciation, and for whatever reason don’t want to write off 100% of the cost, you can elect not. Qualified improvement property is considered any improvement made to an interior portion of a nonresidential building that was. Under the new proposed rules, if a. Can You Take Bonus Depreciation On A Building.

From www.physicianonfire.com

Take Advantage of 100 Bonus Depreciation While You Still Can Story Can You Take Bonus Depreciation On A Building Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. Qualified improvement property is considered any improvement made to an interior portion of a nonresidential building that was. Can i take bonus depreciation on real estate property? Suppose you’re purchasing new real estate property for. Can You Take Bonus Depreciation On A Building.

From www.buildium.com

Bonus Depreciation Saves Property Managers Money Buildium Can You Take Bonus Depreciation On A Building Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production. Can i take bonus depreciation on real estate property? If you purchase property that qualifies for bonus depreciation, and for whatever reason don’t want to write off 100% of the cost, you can elect not.. Can You Take Bonus Depreciation On A Building.

From russellaaiden.blogspot.com

Yearly depreciation formula RussellAaiden Can You Take Bonus Depreciation On A Building You can elect to take an 80% special depreciation allowance for property acquired after september 27, 2017, and placed in service after december 31, 2022, and before january 1, 2024. Suppose you’re purchasing new real estate property for your rental business in tax years when bonus. If you purchase property that qualifies for bonus depreciation, and for whatever reason don’t. Can You Take Bonus Depreciation On A Building.

From rctruckstop.com

Can You Take Bonus Depreciation on a Semi Truck? RCTruckStop Can You Take Bonus Depreciation On A Building Can i take bonus depreciation on real estate property? If you purchase property that qualifies for bonus depreciation, and for whatever reason don’t want to write off 100% of the cost, you can elect not. Qualified improvement property is considered any improvement made to an interior portion of a nonresidential building that was. You can elect to take an 80%. Can You Take Bonus Depreciation On A Building.